GST Assessment in Kerala

STANDARD PLAN

Drafting reply for notices with legal interpretations and case laws

Free Consultation

Drafting reply for notices with legal interpretations and case laws

GST Assessment is the determination of GST liability under the statute and includes self-assessment, scrutiny assessment, Provisional assessment, best judgment assessment, Assessment of non-filers of returns and Assessment of unregistered persons. At times, the authorities may issue notices for defaults made and for seeking clarifications and you may need professional assistance to deal with them. Sometimes the issue may be resolved by drafting a reply to the notice and sometimes it may require representation with data/ report preparation and submission. However, ignoring these notices / demands from the authorities and not closing the issues on time may lead to serious repercussions in the income and exorbitant penalties. Contact your expert for GST Assessment in Kerala

Related articles:

Which ITR to file | National Pension Scheme (NPS)

Related videos:

Let’s GRASP on INPUT TAX CREDIT | Impact of GST and Income Tax on Film Industry

You may be interested in

[print_vertical_news_scroll s_type=”classic” maxitem=”200″ padding=”10″ add_link_to_title=”1″ show_content=”1″ delay=”90″ height=”200″ width=”100%” scrollamount=”1″ direction=”down” ]

The notice sent by the authorities shall be analysed in detail to find out the issue.

The facts of details given in notice shall be checked with the underlying information.

The data required for drafting the reply shall be collecting by digging the available documents and information.

Similar issues, case laws and applicable provisions shall be analysed in detail to make grounds for drafting the reply.

The reply shall be drafted by considering the data collected and legal interpretations.

The reply prepared shall be uploaded with supporting documents and the issue shall be closed.

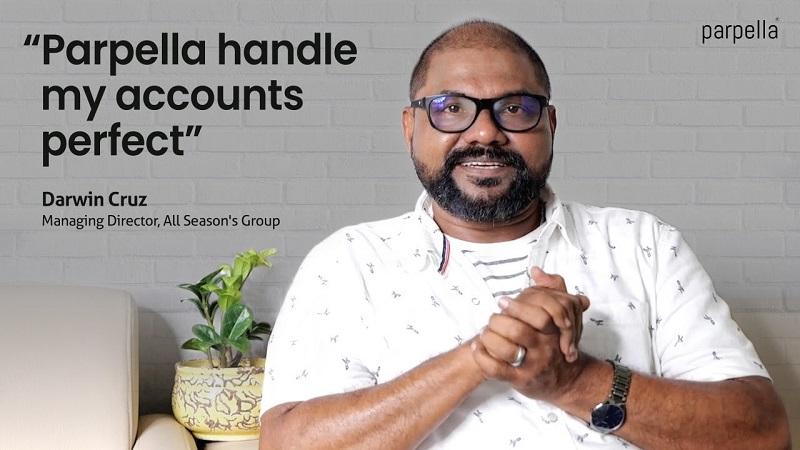

Parpella can help you with pre assessment document preparations and submissions and also with representation before the authorities and engaging in litigations with the authorities. Contact us for your Company Registration in Kerala and Business Registration in Kerala today